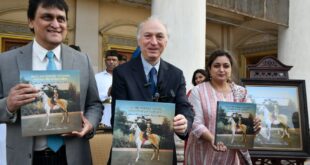

Hyderabad, February 8: The Indian government has no money to deliver on the numbers it presented while announcing the 2020-2021 Union Budget, said Member of Parliament and former Finance Minister Mr P Chidambaram. Presenting a perspective on State of Indian Economy ‘Union Budget 2020-21’ at Muffakham Jah College of Engineering and Technology in Hyderabad, Mr Chidambaram said if the government had enough money, it would not be under-spending in the current year.

Decrying flaws in the Union Budget, the former Finance Minister said the BJP government’s blunders, one after the other, lead to this crisis. The government has no money to spend, nor does the average Indian customer. Blaming demonetization for cutting India’s progress short, Mr. Chidamabaram who was the finance minister in the Congress-led government for a decade (2004-2014), blamed the government’s ineptitude for the slowdown.

The Harvard educated lawmaker and author of nearly half a dozen books was presenting a detailed analysis of the 2020-21 budget announced by the Finance Minister Ms Nirmala Sitharam last week.

Throwing light on the status quo across different verticals, he said ‘most sectors in the country are performing at subnormal capacities.

“The consumer demand for goods and services have shrunk due to the economic slowdown triggered by demonization and implementation of ‘flawed GST’”, he said terming these two as “the biggest blunders” by any government in the history of Indian economy.

The government’s decision to demonetize high value currency notes, which constituted to 85% of the currency value, stopped India’s progress in its feet affecting consumer habits, thawing demand, and freezing sales of consumer goods and services. The situation further worsened when its ripple effects restrained growth of several sectors including automobile, manufacturing, and even agriculture sector, which is now growing at a meager two percent. “Performance of almost every sector shows economic suffering”, he said.

According to Mr. Chidambaram, “in the current year, the government claims it plans to collect rupees 16,49,000 crores (approx. USD 230 billion) as net tax collection, but it will face a loss of nearly 1,45,000 crore rupees (approx. USD 20.28 billion) as the government wouldn’t be able to collect such amount by this March, which marks the end of financial year.

Citing statistical data, he said “the government plans to spend 27,86,000 crore rupees (USD 389.65 billion) in the current year, but at the end of the year only 26,98,000 crore rupees (USD 377.34 billion) have been spent. The market believes that the government does not have the money to spend. It is just giving an estimate of what it plans to spend”, he described.

“None of the numbers the government is quoting are correct including the revenue deficit and the Fiscal deficit. Every number is suspect, every analyst, every investor, every major fund house, everyone knows {that} all these numbers are suspect, which is why there is such pessimism after the budget was presented”, he pointed.

He blamed the government for its inability to collect the taxes, and termed the flawed implementation of GST as ‘tax terrorism’.

According to Mr. Chidambaram, “Corporation Tax has a shortfall of 96,000 crore rupees (USD 13.43 billion), personal income tax has a shortfall of 10,000 crore rupees (USD 1.4 billion), customs 30,000 crore (USD 4.2 billion), excise 52,000 crore (USD 7.27 billion) and GST has a shortfall of 51,000 crore rupees (USD 7.13 billion). No tax is being collected according to the law”.

“This indicates that every sector of the economy is sick, and performing badly, therefore not able to generate income, not able to generate business. Everybody is performing below expectations, which is why the investments are such doomed”, he said attributing these factors to the government’s inability to adequately spend on welfare schemes.

Automobile is always a benchmark in understanding Indian economy, but the automobile sector is currently one of the worst hit.

Earlier, he compared Mrs. Nirmala Sitharaman’s budget presentation to the budget presented by Former Finance Minister Manmohan Singh, he said Sitharaman’s budget view lacked candor. However, the former finance minister admitted that 2014-15, the first year of BJP-led Modi government, achieved high growth and it continued in 2015-16.

‘Despite being in opposition, I was happy to see the country’s growth, until demonization happened’, he said lamenting at the fiscal deficit which is at 6.5%.

“Even before the country could recover from demonetization, the implementation of flawed GST further made it worse. Even though GST as an idea is not bad, the implementation and deprivation of refunds has made it worse. Whatever was left behind after demonetization, it was destroyed by GST. Due to which India’s growth rate began to slide down, from 8.2% to 5% in just six quarters.”

The government will never admit that these were monumental blunders, he claimed.

‘The (present) government was living in denial, and can therefore never come up with a roadmap to development. Merely, making promises that good days are around the corner (ache din aane wale hain..) will reap no results, he said.

He said “the automobile industry alone, has suffered with over 2 lakh jobs lost and 296 workshops closed”. Terming Micro Small and Medium Enterprises (MSMEs), the employment engine of the nation responsible for providing 93% of jobs in India, he said MSMEs have also taken a beating. He said “even automobile companies that worked for 7 days a week are now clocked down to 4 days a week”, which is a deplorable indicator of the slowdown under the present government.

As the idea of India becoming a 5 trillion dollar economy by 2024 is far-fetched as new budget shatters all hope of development, and shuns progress. He even termed it the ‘most anti-poor budget in the history of India’.

Contrasting claims of the Finance Minister Nirmala Sitharam with statistical data, he questioned “if all is well, why is the government not able to collect tax as it has claimed earlier. The corporate tax collection, personal tax collections and different taxes are all under collected.

The government’s new slogan Sabka Saath, Sabka Vikaas, Sabka Vishwas have failed at implementation with youth going jobless, more than 40% students undernourished, and many who cannot even access food due to prices. This is the most anti poor government in the history of India.

The government is not able to collect the taxes. Corporation Tax there is a shortfall of 96,000 crore, personal income tax shortfall of 10,000 crore, customs 30,000 crore, excise 52,000 crore on GST 51,000 crore. No tax is being collected according to the law.

This indicates that every sector of the economy is sick, and performing badly, not able to generate income, not able to generate business, everybody’s performing below expectations, which is why the investments are such doomed.

He said “Investors do not want to invest their money in India’s manufacturing sector as it is working at 70% capacity, while the automobile industry has further slipped down to 50% capacity. In Automobile sector alone, over 2 lakh jobs were lost and 296 workshops were closed. The Micro Small and Medium Enterprises which are responsible for providing over 90% of jobs in India are gravely affected by these changes. With the existing organizations stripping down to subnormal capacity, why would anyone want to invest more in these sectors, he said.

Mr. Chidambaram is also a Member of Parliament in the Upper House since 2016.

The Indian Economy is currently the fifth largest in the world and tipped to be nearly 2.8 trillion, which the ruling BJP government has claimed to leverage to 5 trillion dollars by 2024.

Gawah (The Witness) – Hyderabad India Fearless By Birth, Pristine by Choice – First National Urdu Weekly From South India – Latest News, Breaking News, Special Stories, Interviews, Islamic, World, India, National News

Gawah (The Witness) – Hyderabad India Fearless By Birth, Pristine by Choice – First National Urdu Weekly From South India – Latest News, Breaking News, Special Stories, Interviews, Islamic, World, India, National News